Chinese EVs Storm UK Market: What It Means for British Drivers

How Asian manufacturers went from zero to hero in just five years – and why your next car might be Chinese

Picture this: It's 2019, you're shopping for an electric car, and your choices are basically a Tesla Model 3, a Nissan Leaf, or if you're feeling adventurous, a BMW i3. Fast forward to today, and the UK's electric vehicle landscape has been completely transformed by an invasion from the East that nobody saw coming.

Chinese car manufacturers, virtually unknown in Britain just five years ago, now command a staggering 10% of the UK's electric vehicle market. From budget-friendly city cars starting at under £19,000 to luxury SUVs packed with technology that would make a Tesla blush, these new arrivals aren't just competing – they're winning.

Chinese brands like BYD and MG are rapidly expanding across the UK, with over 170 dealerships already operational and hundreds more planned

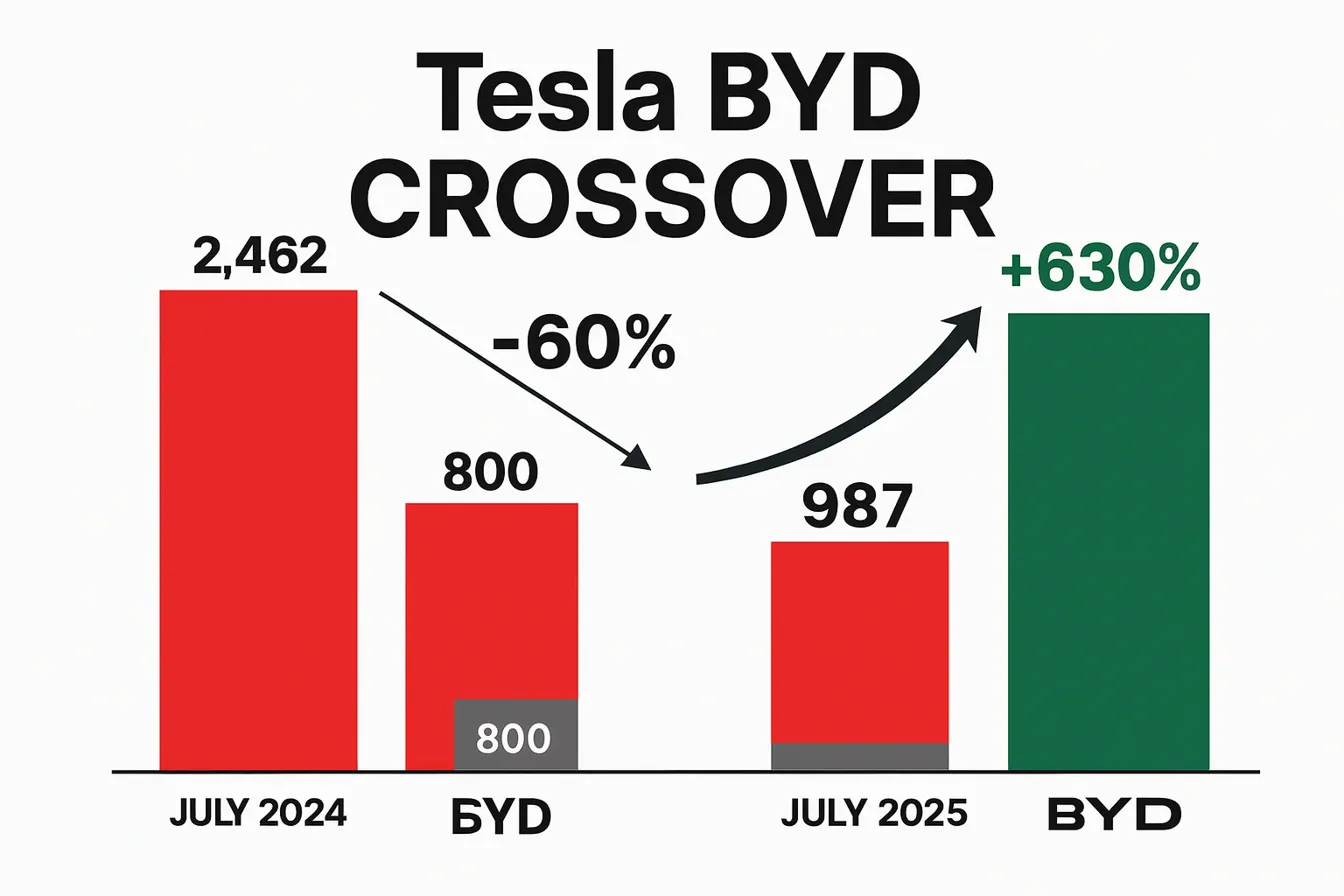

The latest figures from the Society of Motor Manufacturers and Traders (SMMT) paint a remarkable picture: BYD, a company most Brits hadn't heard of two years ago, outsold Tesla by three to one in July 2025. MG, once a beloved British marque now owned by China's SAIC Motors, has overtaken Fiat in total UK sales. And this is just the beginning.

From Non-Existent to Everywhere: The Lightning Rise

The transformation has been breathtaking in its speed. According to data from Transport & Environment, Chinese brands accounted for less than 1% of UK EV sales in 2019. Today? They're pushing past 10% and accelerating rapidly.

"The intensity of this shift caught everyone off guard," says industry analyst Felipe Munoz from JATO Dynamics. "Chinese brands doubled their European market share to 5.9% in May 2025 alone. Despite EU tariffs on Chinese electric vehicles, these brands continue to post strong growth across Europe."

The numbers tell only part of the story. Walk through any UK city today and you'll spot these newcomers everywhere – the distinctive BYD Dolphin with its playful design, the surprisingly sophisticated MG4, or the tech-laden Omoda E5. What seemed impossible just five years ago is now everyday reality.

Meet the New Players Reshaping Britain's Roads

Understanding who these companies are helps explain their rapid success. These aren't startup ventures hoping to make it big – they're industrial giants backed by decades of battery expertise and the world's largest EV market.

BYD: The Giant You've Never Heard Of

BYD (Build Your Dreams) started as a battery manufacturer in 1995, making batteries for mobile phones. Today, it's the world's largest EV manufacturer, having delivered over 3.7 million vehicles in 2023 alone. Warren Buffett's Berkshire Hathaway has been a major shareholder since 2008, seeing something the rest of us missed.

The BYD Dolphin, starting at just £18,650, offers features typically found in cars costing twice as much

In the UK, BYD's growth has been explosive. From just 14 dealerships at the start of 2024, they're expanding to 100 by the end of 2025. Their secret weapon? The revolutionary Blade Battery – a lithium iron phosphate design that's safer, cheaper, and more space-efficient than traditional batteries. It's so good that Tesla now uses BYD batteries in some of its cars.

UK Sales Q1 2025: 24,641 units

Market Share: 4.24% of total UK market

Key Model: MG4 (from £26,995)

USP: British heritage with Chinese efficiency

UK Entry: 2024

Achievement: #1 configured car Q2 2025

Key Model: Omoda E5

USP: Tech-forward features at mainstream prices

Dealerships: 71 (130 planned by 2025)

Key Model: Jaecoo 7 SUV

Target: Range Rover Evoque buyers

USP: Premium feel, mainstream price

And they're just the advance guard. XPeng arrived in February 2025 with AI-driven technology and plans for 20 UK dealerships. Leapmotor is entering through a partnership with Stellantis. NIO is bringing battery-swap technology with 25 UK locations planned. The invasion is far from over.

The Price Revolution: How They're Undercutting Everyone

Perhaps nothing illustrates the Chinese disruption better than pricing. Auto Trader's latest research shows Chinese manufacturers have increased sub-£30,000 EV options from 9 to 29 models in just one year. The price gap between EVs and petrol cars has fallen from 35% to 24% – a drop of £3,600.

Real-World Price Comparison: Small Electric Hatchbacks

| Model | Starting Price | Range | Standard Features |

|---|---|---|---|

| BYD Dolphin | £26,195 | 211 miles | 360° cameras, rotating screen, wireless charging |

| MG4 | £26,995 | 218 miles | V2L charging, rear camera, smartphone app |

| Volkswagen ID.3 | £34,995 | 265 miles | Digital cockpit, app connect, rear camera |

| BMW i3 (discontinued) | Was £36,000+ | 190 miles | Navigation, climate control, parking sensors |

"What's remarkable isn't just that Chinese EVs are cheaper," notes Tu Le, founder of Sino Auto Insights. "It's that they're cheaper while offering more. A £20,000 Chinese EV typically includes features you'd only find on a £35,000 European model."

Take the BYD Dolphin Surf at £18,650. For less than £19,000, buyers get a rotating touchscreen, intelligent cruise control, and automatic emergency braking – features that would have been luxury items just five years ago. Compare that to the Citroën ë-C3 at a similar price, and the value proposition becomes clear.

Not Just Cheap – They're More Advanced Too

Here's where preconceptions get shattered. Chinese EVs aren't winning on price alone – they're often technologically superior to their Western counterparts. The latest announcement from BYD sent shockwaves through the industry: they're offering advanced driver assistance systems (ADAS) as standard on cars costing as little as £9,550.

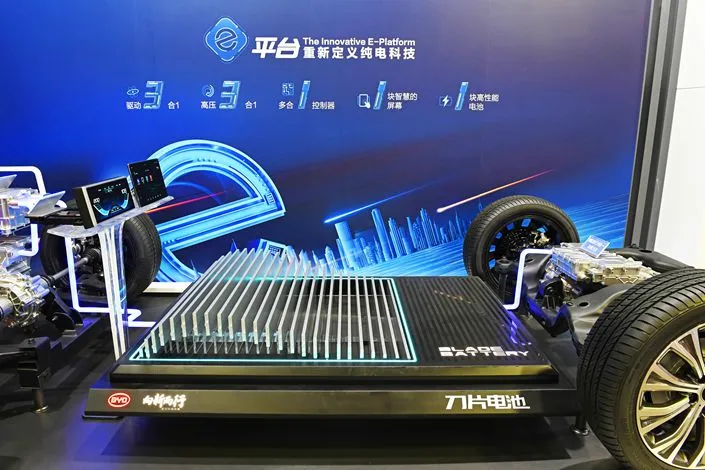

BYD's revolutionary Blade Battery passes the nail penetration test without catching fire – a feat most batteries can't match

The Battery Revolution

BYD's Blade Battery represents a fundamental breakthrough. Using lithium iron phosphate (LFP) chemistry instead of traditional lithium-ion, these batteries are:

- 50% more space-efficient than conventional batteries

- Safer – they don't catch fire even when punctured

- Longer-lasting – rated for up to 1.2 million kilometres

- Cheaper to produce – helping drive down vehicle costs

Professor Ouyang Minggao from the Chinese Academy of Sciences explains: "In terms of battery safety and energy density, BYD's Blade Battery has obvious advantages. The singular cells are arranged together in an array and inserted into a battery pack, increasing space utilization by over 50%."

Autonomous Driving for the Masses

In February 2025, BYD announced something unprecedented: their "God's Eye" autonomous driving system would be standard across 21 models, including their entry-level Seagull priced at just £9,554. For context, Tesla charges $8,000 (about £6,300) for its Full Self-Driving package on top of the car's price.

What You Get for Under £10,000:

- ✓ Level 2 autonomous driving capability

- ✓ Highway navigation and automatic lane changes

- ✓ Self-parking with 2cm accuracy

- ✓ Emergency braking at 100 km/h

- ✓ AI-powered perception using DeepSeek technology

- ✓ Over-the-air updates for continuous improvement

This isn't stripped-down technology either. BYD's system uses 12 cameras, 5 millimeter-wave radars, and 12 ultrasonic sensors – similar to what you'd find in premium German cars costing three times as much.

The Establishment Strikes Back (Or Tries To)

The impact on traditional manufacturers has been swift and, in some cases, brutal. Tesla's UK sales plummeted 60% year-on-year in July 2025, with BYD selling three times as many vehicles. The company that once seemed untouchable in the EV space is suddenly looking vulnerable.

German luxury brands are feeling the pressure too. According to JATO Dynamics, Chinese brands outsold Mercedes in June 2025 and Ford in the first half of the year. BMW and Volkswagen, heavily dependent on the Chinese market for profits, now find themselves losing ground both at home and abroad.

"Western manufacturers have lost sales in Asia to these domestic brands, and now Chinese car firms want to repeat the trick in Europe. The momentum is partly due to their decision to push alternative powertrains to the region."

- Felipe Munoz, Global Analyst at JATO Dynamics

The response from established players has been mixed. Some, like Stellantis, are partnering with Chinese companies (Leapmotor) to access their technology. Others are slashing prices – the industry spent over £4 billion on EV discounts in 2024 alone trying to meet sales targets. Mercedes, BMW, and Volkswagen are lobbying hard for increased tariffs, despite their own heavy reliance on Chinese production and sales.

BYD's UK sales have surged past Tesla's, marking a dramatic shift in the EV landscape

Japanese manufacturers face an existential crisis. Having bet heavily on hybrid technology, companies like Toyota and Honda find themselves outflanked in the pure EV market. Nissan, once a leader with the Leaf, is now in merger talks with Honda as both struggle to compete.

What British Drivers Really Think

The consumer response has been fascinating to watch, with a clear generational divide emerging. Auto Trader's Road to 2030 study reveals that 57% of drivers aged 17-34 are willing to consider Chinese brands, attracted by innovative technology and affordability. Among over-55s, that figure drops to just 25%.

"Initially, there was scepticism," admits Ian Plummer, Auto Trader's Commercial Director. "But consumers' trust in the quality and safety of these new entrants is growing, particularly among younger buyers who judge these cars on merit, not origin."

Common Concerns About Chinese EVs:

- Data security and privacy – 41% of over-55s worry about data risks

- Build quality – 43% question long-term reliability

- Brand unfamiliarity – Will these companies still exist in 5 years?

- Resale values – What will these cars be worth?

- Service network – Can I get it fixed locally?

Yet despite these concerns, the sales figures speak for themselves. Young families are snapping up BYD Dolphins for their practicality and price. Tech enthusiasts are drawn to XPeng's AI features. Even conservative buyers are being won over by MG's combination of British heritage and Chinese value.

Sarah Chen, a 32-year-old teacher from Manchester who recently bought a BYD Atto 3, represents this new wave of buyers: "I test drove a VW ID.3 and the BYD back-to-back. The BYD was £8,000 cheaper and had more features. The quality felt just as good. It was a no-brainer."

How They Do It: The Secret Behind the Prices

Understanding how Chinese manufacturers achieve these prices while maintaining (or exceeding) quality requires looking at their fundamental advantages.

Vertical Integration

BYD doesn't just assemble cars – they make their own batteries, chips, and even the raw materials. This vertical integration eliminates middleman costs and supply chain vulnerabilities. When chip shortages crippled Western manufacturers in 2021-2022, BYD kept building.

Scale Beyond Comprehension

China sold 13 million EVs in 2024 – four times more than the United States. This massive domestic market provides economies of scale that Western manufacturers can't match. BYD alone added 200,000 employees in 2024 – more than GM's entire global workforce.

Government Support

The Washington Post reports that China has invested an estimated $231 billion (£172 billion) developing its EV industry since 2009. This includes everything from battery research to charging infrastructure to consumer subsidies.

Speed of Innovation

Chinese companies develop new models in 18 months versus 3-4 years for traditional manufacturers. This rapid iteration allows them to incorporate the latest technology and respond quickly to market demands.

BYD introduces Blade Battery – Revolutionary LFP technology that's safer and cheaper than traditional batteries

First Chinese brands arrive in UK – BYD and GWM begin UK sales with handful of dealerships

Expansion accelerates – Chinese brands reach 8% of European EV market despite new tariffs

Mass market breakthrough – BYD outsells Tesla, Chinese brands hit 10% UK market share

What This Means for Britain's Automotive Future

The implications of this shift extend far beyond car showrooms. The UK's automotive industry, already weakened by Brexit and the decline of domestic manufacturing, faces fundamental questions about its future.

The Dealership Revolution

Traditional dealerships are scrambling to secure Chinese franchises. With 16+ new brands entering the market, there's a gold rush for retail space and trained technicians. But these aren't your father's dealerships – many Chinese brands prefer shopping centre locations and direct sales models.

The Aftermarket Opportunity

For British aftermarket businesses, from car accessory manufacturers to service centres, the influx presents both opportunities and challenges. These new vehicles need parts, accessories, and servicing – but their requirements differ from traditional cars.

The UK's charging network is expanding rapidly to meet demand, with over 65,000 public chargers now available

Opportunities for UK Businesses:

- ✓ New vehicle templates and specifications to support

- ✓ Growing market of tech-savvy, younger customers

- ✓ Demand for quality British-made accessories and upgrades

- ✓ Service and support gaps to fill

- ✓ Export opportunities to other markets experiencing similar shifts

The Political Dimension

The success of Chinese EVs is forcing difficult political decisions. The EU has already imposed tariffs up to 35% on Chinese EVs, though even with these additional costs, Chinese brands remain competitive. The UK, having left the EU, must chart its own course – balancing consumer benefits against domestic industry protection.

Mike Hawes, SMMT chief executive, captures the industry's dilemma: "The automotive industry welcomes the government's review of both the end of sale date for cars powered solely by petrol or diesel, and possible changes to the Zero Emission Vehicle Mandate. These are critical issues for an industry facing significant challenges globally."

The Road Ahead: 2030 and Beyond

Industry projections suggest Chinese brands could capture 25% of the UK EV market by 2030. Urban Science forecasts that by decade's end, Chinese manufacturers will be established players across Europe, forcing a complete restructuring of the automotive industry.

What seems certain is that the changes we've seen are just the beginning. Coming developments include:

- Solid-state batteries promising 1,000-mile range by 2027

- Level 3 autonomous driving as standard by 2028

- 10-minute charging becoming commonplace

- Sub-£15,000 EVs making electric cars truly mainstream

- Battery-swap technology eliminating charging times entirely

For British consumers, this competition is unquestionably positive. More choice, lower prices, and better technology benefit everyone. But for the broader UK economy and traditional automotive sector, the transition will be painful.

"We don't know if Chinese EVs in the UK will ultimately dominate like Japanese cars did in the 1970s and 80s. But the parallels are striking. Dismissed initially as cheap and inferior, Japanese cars eventually came to define reliability and value. History may be repeating itself."

- Quentin Willson, FairCharge Founder

What This Means for You as a Car Owner

If you're in the market for a new car, the Chinese invasion has fundamentally changed your options. You can now buy a well-equipped electric car for the price of a mid-spec petrol hatchback. Features that were luxury items five years ago – from panoramic roofs to advanced driver assistance – are now standard on budget models.

For existing car owners, the implications are mixed. The flood of affordable EVs may depress used car values, particularly for diesel vehicles. But it also means upgrades and accessories designed for these new vehicles are becoming widely available, often at competitive prices from British suppliers keen to capture this new market.

The service and support ecosystem is evolving rapidly. Independent garages are training technicians on Chinese EV systems. Aftermarket suppliers are developing products specifically for these vehicles. British companies that move quickly to support these new brands stand to benefit significantly.

Chinese EVs often feature premium interiors with vegan leather, ambient lighting, and large displays as standard

Should You Buy a Chinese EV?

The answer increasingly seems to be: why not? Euro NCAP safety ratings for Chinese EVs match or exceed traditional brands. Warranties are often longer (BYD offers 8 years on batteries). The technology is frequently superior. And the prices are unbeatable.

The main considerations remain:

- Brand longevity – Will the company still exist in 5-10 years?

- Resale values – Currently unknown for most Chinese brands

- Service network – Still developing but expanding rapidly

- Parts availability – Improving but not yet matching established brands

For many buyers, particularly younger ones entering the EV market, these concerns are outweighed by the immediate benefits of lower prices and superior technology.

The Bottom Line: A Revolution You Can't Ignore

The Chinese EV revolution in the UK isn't a future possibility – it's today's reality. In just five years, Chinese manufacturers have gone from non-existence to commanding 10% of the electric vehicle market, with projections suggesting they could reach 25% by 2030.

This isn't just about cheap cars flooding the market. These vehicles often offer superior technology, from revolutionary battery designs to advanced autonomous features, at prices that undercut Western competitors by 20-40%. When BYD can offer self-driving technology as standard on a £9,550 car while Tesla charges £6,300 for similar features, the disruption is clear.

The impact extends throughout the automotive ecosystem. Traditional manufacturers are slashing prices, forming partnerships, or in some cases, facing existential crisis. Dealerships are adapting to new brands and business models. The aftermarket is racing to support vehicles with different specifications and requirements.

For British consumers, this competition brings unprecedented choice and value. For British businesses, it presents both threat and opportunity – those who adapt quickly to support these new vehicles and their owners stand to thrive in the new landscape.

The Key Takeaways:

- Chinese EVs now offer the best value proposition in the UK market

- Technology leadership, not just price, is driving their success

- Traditional manufacturers are struggling to compete

- Young buyers are embracing these brands enthusiastically

- The transformation will accelerate, not slow down

- UK businesses must adapt quickly or risk obsolescence

Love them or fear them, Chinese EVs are here to stay. They're not just changing what we drive – they're revolutionising how we think about cars, technology, and value. The UK automotive market will never be the same again.

As one industry veteran put it: "We spent years wondering when the Chinese would arrive. We should have been preparing for when they conquered."

That conquest is now well underway. The only question is: are you ready for it?

Driving a Chinese EV? Your Car Deserves British Quality

Whether you've joined the Chinese EV revolution or are sticking with traditional brands, protect your investment with premium car mats from the UK's most trusted manufacturer.

Now supporting all major Chinese EV brands including BYD, MG, Omoda, Jaecoo, XPeng and more!

35 years of British manufacturing excellence • Perfect fit guarantee • 18-month warranty

Research Sources & References

This analysis draws on data from multiple authoritative sources including:

- • Society of Motor Manufacturers and Traders (SMMT) - UK vehicle registration data

- • JATO Dynamics - European automotive market analysis

- • Auto Trader - Road to 2030 consumer research study

- • Transport & Environment - EV market share analysis

- • The Electric Car Scheme - Chinese EV brand overview

- • Nationwide Vehicle Contracts - Market growth statistics

- • Urban Science - European EV market forecasting

- • Company reports from BYD, MG, Tesla, and other manufacturers

- • The Washington Post - Chinese EV industry analysis

- • Financial data from Yahoo Finance and Bloomberg

Data current as of August 2025. Market conditions and statistics subject to rapid change in this dynamic sector.